Orion Alpha 2026 H1 US Equity Outlook

Navigating the 2026 Landscape: Growth, Risk, and the AI Inflection Point

2026 is defined by a paradox of high expectations and structural fragility. Sell-side analysts remain notably bullish, with major institutions setting year-end S&P 500 targets between 7500 and 7800. This optimism is rooted in the belief that the "AI theme" is entering a more mature phase, supported by resilient corporate margins and a Federal Reserve that has transitioned into a supportive, easing stance. However, seasoned investors are closely monitoring historical parallels to the late 1990s tech boom, noting that after several years of double-digit gains, the market growth rate may moderate toward a projection of roughly 10%.

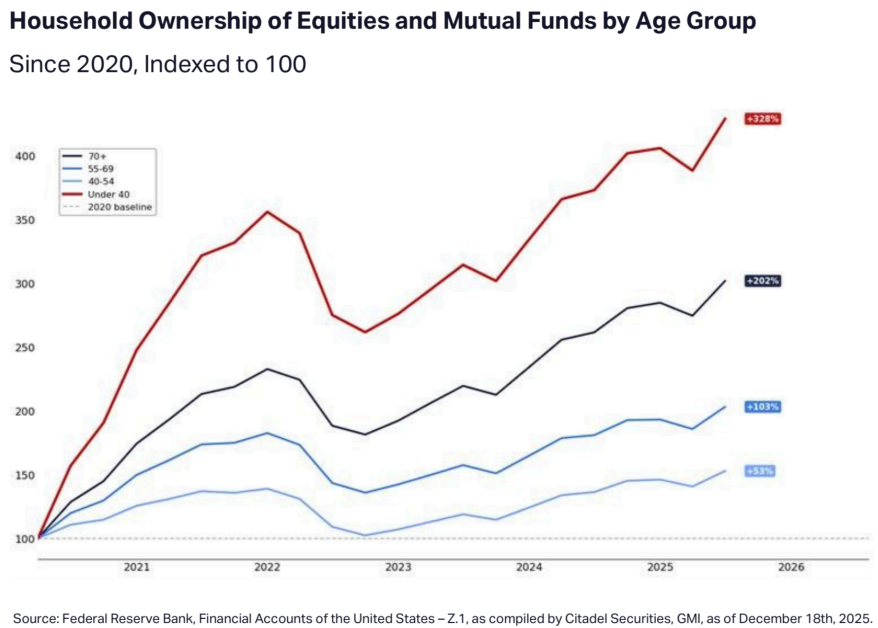

The Pillars of Market Support: Retail Liquidity and Fiscal Stimulus

Market support in 2026 is bolstered by a unique combination of record-high retail participation, aggressive fiscal stimulus, and a pivot in monetary policy focused on economic stability. Unlike previous cycles, individual investors now command nearly 60% of total U.S. market capitalization, including indirect holdings. This retail-driven momentum reached a new milestone as net purchases climbed from roughly $80 billion in 2014 to over $310 billion by late 2025(Vanda Research), providing a significant floor for equity prices through consistent "buy-the-dip" behavior.

Fiscal Stimulus and the OBBBA Impact

A primary catalyst for market liquidity in early 2026 is the One Big Beautiful Bill Act (OBBBA), which was signed into law in July 2025. This legislation provides several critical support mechanisms for both consumers and corporations:

Tax Refunds: The act includes retroactive tax benefits for 2025, with many households expected to receive an average of $1,000 to $1,800 in early 2026. These refunds, totaling approximately $80 billion, are projected to drive immediate inflows into the equity market and boost consumer spending.

Corporate Cash Flow: For businesses, the OBBBA restores permanent 100% bonus depreciation, allowing companies to immediately expense the full cost of capital investments like data centers and software. This shift from capitalization to full expensing significantly improves short-term cash flow—for example, a company with $100 million in CapEx could save $21 million in taxes in a single year.

Small Business Incentives: The act expanded the Qualified Small Business Stock (QSBS) exclusion to $15 million, further incentivizing early-stage investment and capital rotation.

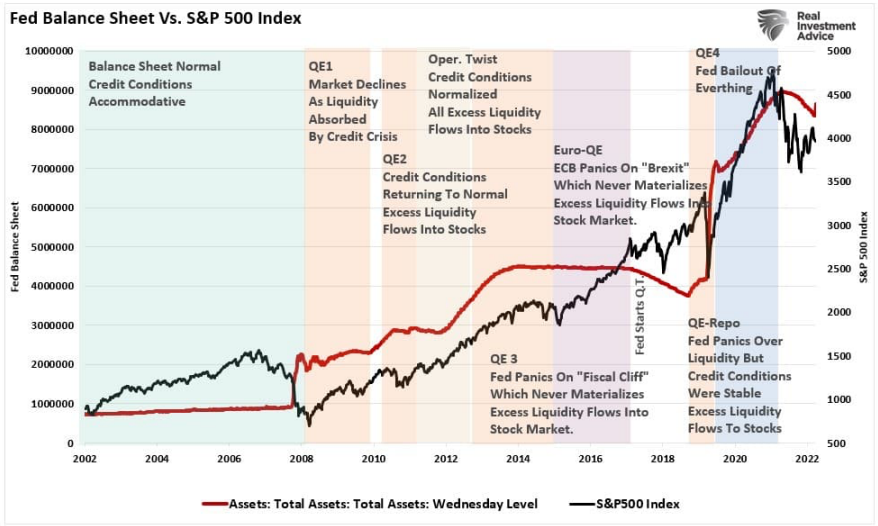

Monetary Policy and the Fed Pivot

The Federal Reserve provides a second pillar of support by transitioning from aggressive inflation control to a stance of "equilibrium management".

Rate Cut Expectations: Market futures and analysts suggest at least two interest rate cuts in 2026—potentially in April and September—to combat a softening labor market.

Dovish Leadership: The Fed's board composition is increasingly seen as supportive of risk assets, with leadership expected to remain data-dependent while prioritizing full employment over strict inflation targets.

End of QT: The cessation of Quantitative Tightening (QT) has stabilized the Fed's balance sheet, ensuring that excess liquidity is no longer being drained from the system, which historically correlates with upward stock market performance.

Structural Resilience and Sector Rotation

Institutional demand remains anchored by the "AI supercycle," which is expected to drive earnings growth of 13% to 15% for the next several years. While mega-cap tech was the primary driver in 2025, market leadership is expanding in 2026 to include small- and mid-cap stocks as AI and automation drive efficiencies across all sectors. This "broadening" of the rally, combined with market-friendly policies, is a key reason many major institutions maintain high S&P 500 year-end targets.

Identifying the Structural Risks

Beneath the surface of index-level gains, two primary risks threaten to derail the current bull run. The first is a deteriorating labor market characterized by "jobless growth," where productivity increases through technology but fail to create the employment levels needed to sustain long-term GDP. If the labor market softens to the point where it can no longer support consumption—the biggest contributor to the U.S. economy—corporate earnings growth could stall.

The second risk involves the sustainability of AI capital expenditures. Tech giants have shifted from capital-light models to capital-heavy ones, and corporate adoption surveys indicate that "Unclear ROI" is now the leading challenge for AI integration, rising to nearly 60% of businesses. While free cash flow for hyperscalers remains healthy for now, the timeline for meaningful AI monetization in areas like search, coding, and e-commerce remains long and uncertain.

Strategic Positioning: The K-Shaped Reality

Portfolio construction for 2026 requires a nuanced approach to a "K-shaped" economy, where wealth and spending power are increasingly bifurcated. While the technology stack—including GPU manufacturers, memory providers, and infrastructure plays like cooling and optics—remains a focus, many managers have begun reducing exposure to these "crowded" trades to manage risk.

Instead, there is a growing emphasis on "affordability" winners. This includes companies like Walmart that capture middle-income spend, as well as discount retailers like Dollar Tree and Dollar General, which benefit as lower-income households struggle with rising utility, food, and healthcare costs. The "affordability crisis" is a key theme, with average monthly energy bills and out-of-pocket health expenses reaching record highs.

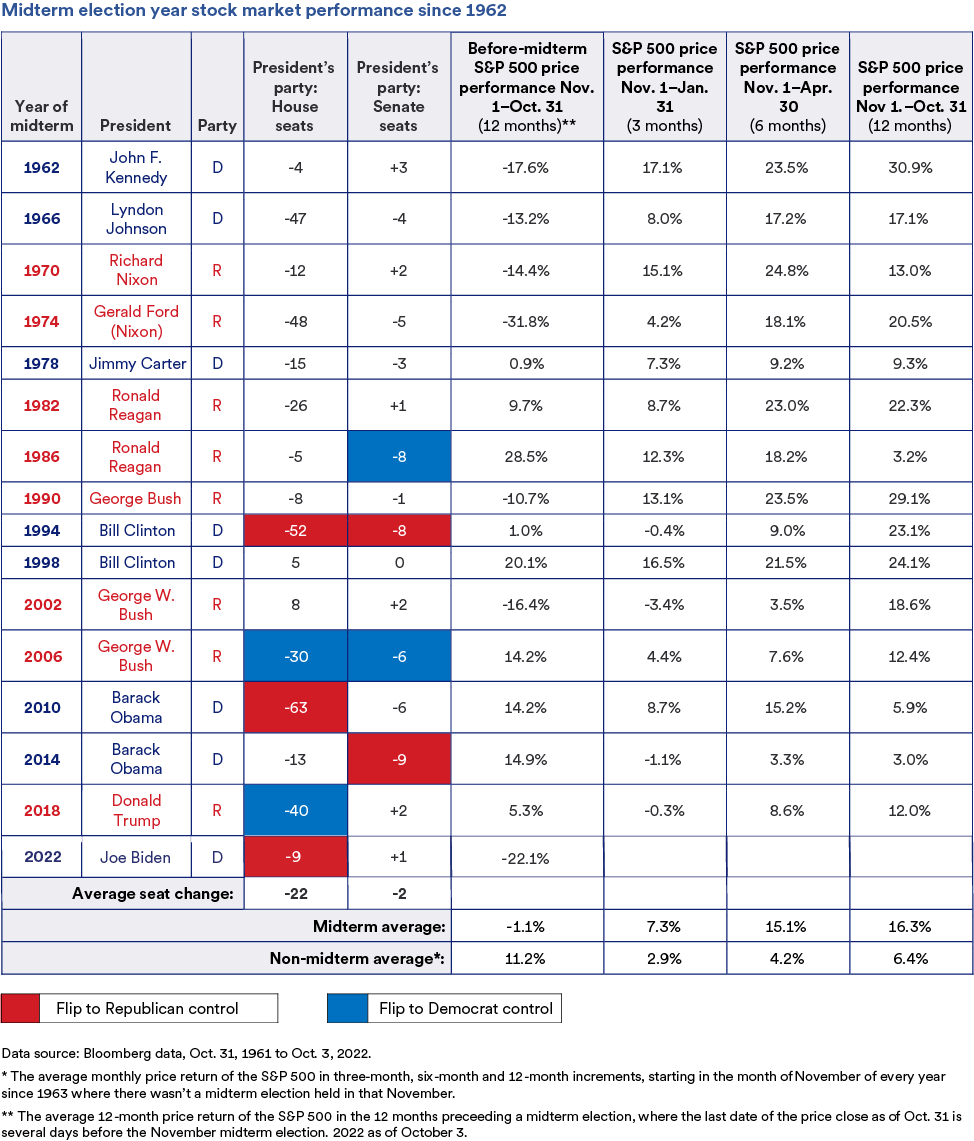

The Midterm Election Factor

The 2026 midterm elections will serve as a critical pivot point for the year's performance. Historically, the twelve months leading up to a midterm election are often stagnant as markets digest policy uncertainty. However, once the election is finalized, the market frequently experiences a robust rally. Investors are advised to watch for tactical entry points in sectors like healthcare, where major insurers may see relief once the legislative outlook becomes clearer following the vote.

Sources:AIG Group, Vanda Research: Retail Investors Driving Recent Bull Market